“…Everyones’ kind of got the same kind of feeling of anxiety about college expenses because no one knows much about expenses yet..” said Erez Levin, senior at Community. Two people that know all about this are the CHS school counselors: Diane Grant and John Boshoven. Grant was in an Reserve Officer Training Corps (ROTC) program at the Rochester Institute Of Technology. Diane definitely had a different story than most people. Grant also has a lot of advice on how to organize and handle expenses.

Now a days not only students are competing for colleges, but colleges are competing for students. According to Grant a lot of colleges didn’t have nice dorms but now the dorms are getting nicer to attract students. People are lucky now because computers and other technologies are very accessible and easy to use and expenses are easy to put into a computer and keep track of. Students have to budget a lot at all times. Kids have to buy the cheapest stuff and can’t afford a lot of the things that they desire.

“If you’re in that place, where you think of this as a really creative challenge. Where you learn a lot and you learn how to survive without a lot of money then you can have a lot of fun doing it and it won’t be stressful. So that’s what I did, I just made a decision to not be stressed out and I documented it because I thought it was kind of a cool process,” said Grant.

One of the ways people pay for college is federal government aid, however, someone can only get federal government aid if their family earns less than fifty to sixty thousand dollars a year, so for a lot of middle class families this isn’t an option. Another big option is the federal government pile, which is where private colleges give money to the kids that they want. “Who don’t they want? Thug man. Thug man, has a mediocre academic experience, mediocre grade point average, and no extra curricular activities. He’s basically a slug, who plays video games with his buddies, sleeps in and doesn’t wash up very well. Colleges aren’t really going to want to throw a lot of money on him because he’s really not somebody they’re going to want on their campus,” said Boshoven.

There’s also another way to get money for college: “The third type of scholarships are the real competitive ones where you have to be superman and clark ken all wrapped up into one. The gates millenium scholarship, The Nike, The Prudential, the big ones with posters, the little ones are little scholarships you might have affiliation with it might be your temple, it might be your insurance agency, might be a club you or your parents belong to that gives scholarships, or it might be a little local club competition type of thing.”

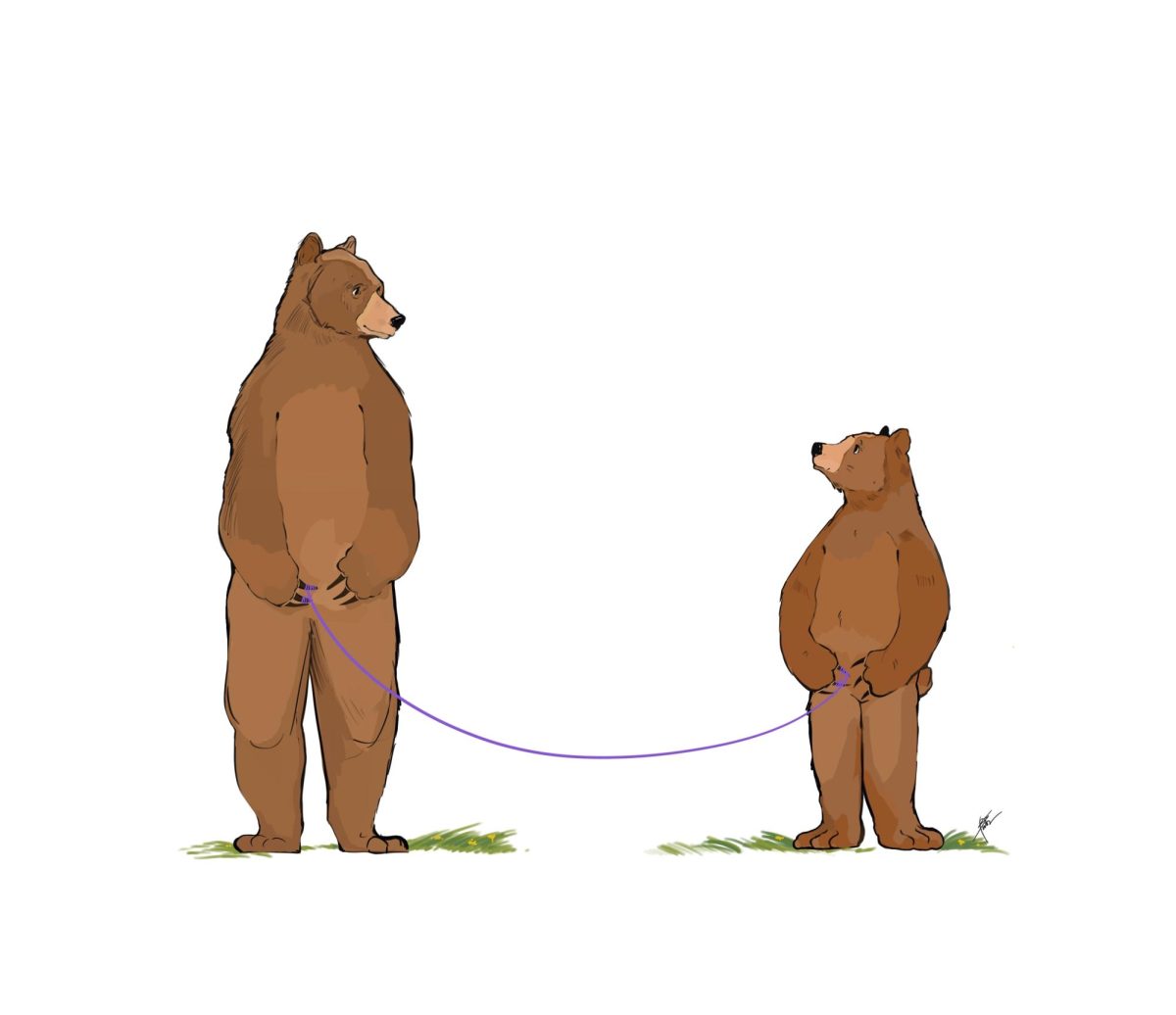

A good way to make paying for things in college easier is to have everything in writing. A student needs to write down the things he/she needs to live and write down the amount of money each thing costs. Also, when people are living with a friend, they need to make sure that the other person is doing an equal amount of work as they are and this needs to be in writing to get rid of any confusion. For example, if two people are living in an apartment, and one isn’t paying the rent, then there needs to be some sort of agreement to make the amount of work equal. The person not paying any of the rent could do all the dishes and cleaning in the house, something like that to make sure that the person who is doing the payment isn’t being completely used.

Another big point is having a financial plan.

“I really learned how to budget my money cause in college you really don’t need a lot of money, everything’s provided for you so when you have your financial package set, when you’re on campus it covers everything,” said Grant.

“…So once you have your financial package set up it’s part of the plan usually at a four year school. So I knew I had a meal card I knew I could have two meals a day… I think meal plans are like really good now cause you can like use your meal plan to buy a starbucks coffee or this or that. So you still have to pay for it but it’s part of the package,” said Grant.

Knowing what your expenses are and planning ahead are very crucial. Knowing how much food would cost and planning out your expenses are very helpful in the long run. For example, having an apartment where you have to pay for gas and electric separately is very taxing, instead, choose an apartment where you the gas and electric bill comes in the same package, therefore you won’t get a surprise bill. “Thats probably the biggest bill that people don’t anticipate. In the winter you can have a four hundred dollar gas and electric bill and you didn’t plan on spending four hundred dollars because in the summer it costs you fifty a month,” said Grant.